Are you scouring the internet for 'indirect taxes essay'? Here you can find the questions and answers on the subject.

Table of contents

- Indirect taxes essay in 2021

- Is gst an indirect tax

- Indirect taxes in india

- Types of indirect taxes

- Direct and indirect taxes

- Direct taxes and indirect taxes

- Indirect taxes in usa

- Indirect tax examples

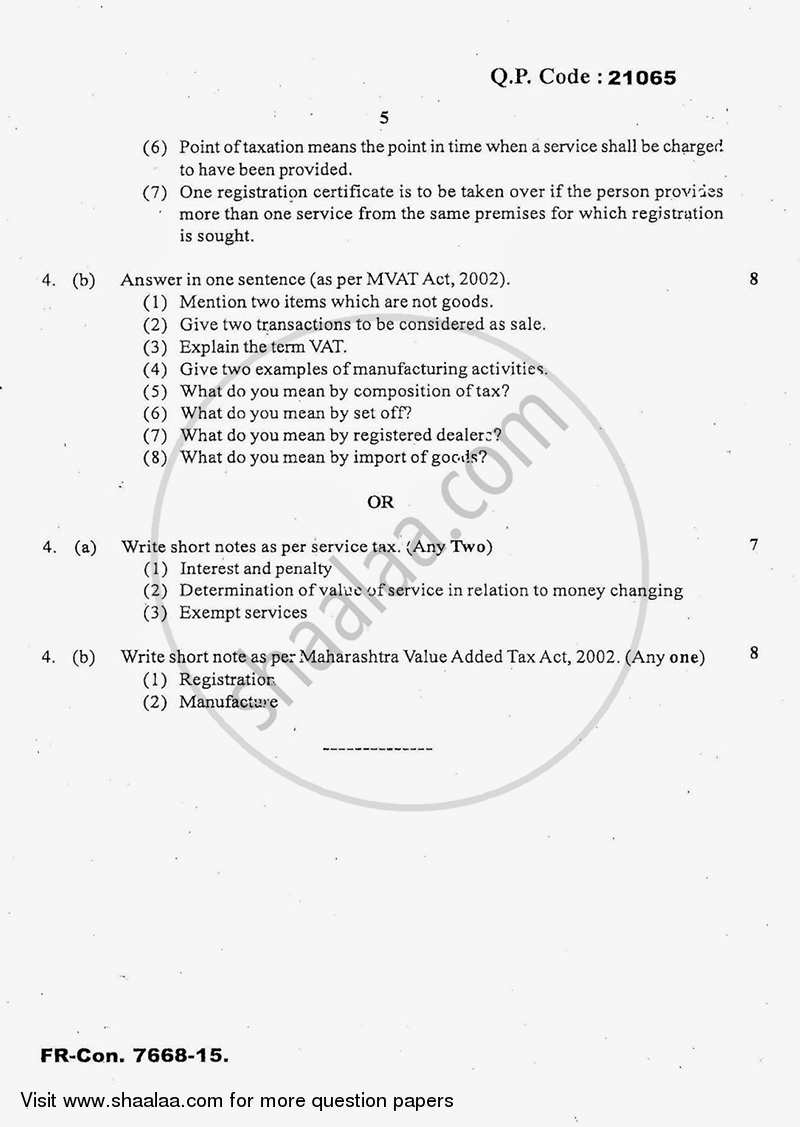

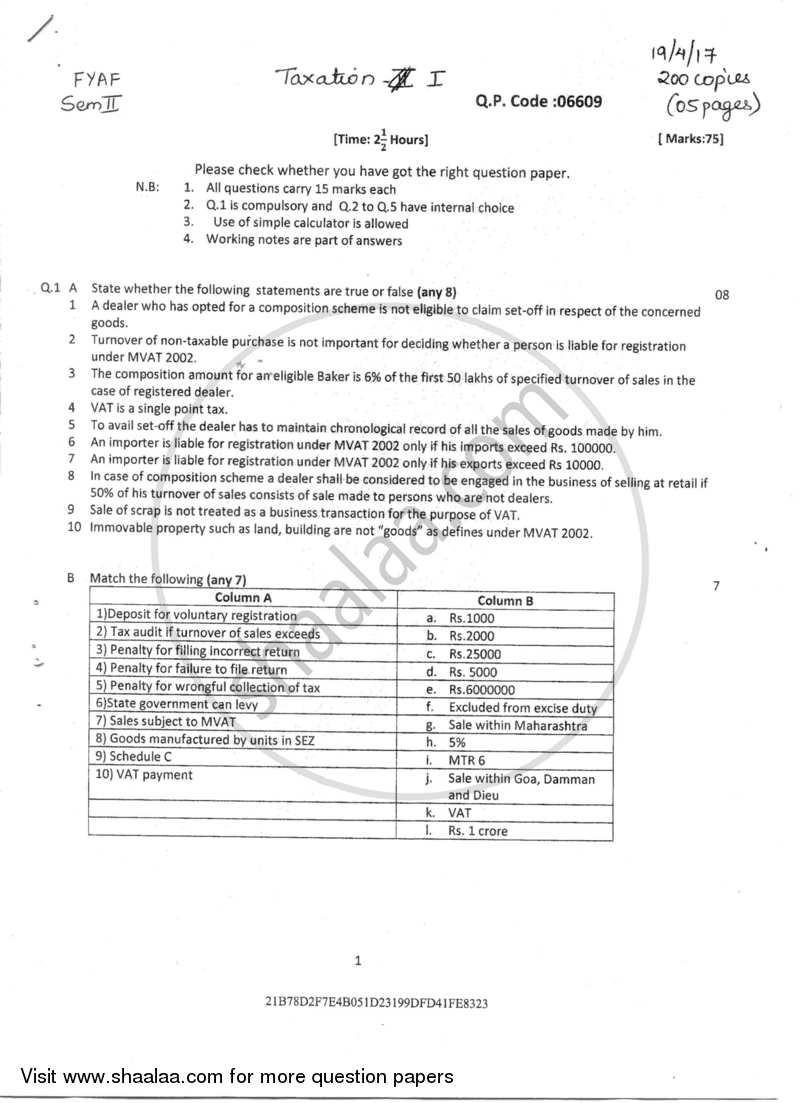

Indirect taxes essay in 2021

This image illustrates indirect taxes essay.

This image illustrates indirect taxes essay.

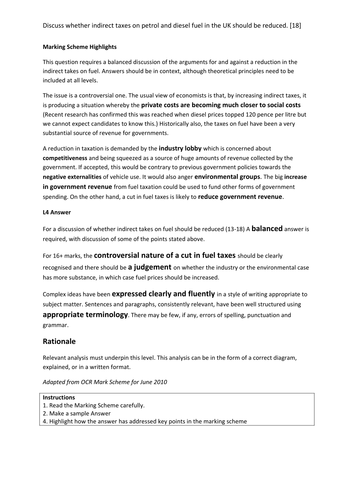

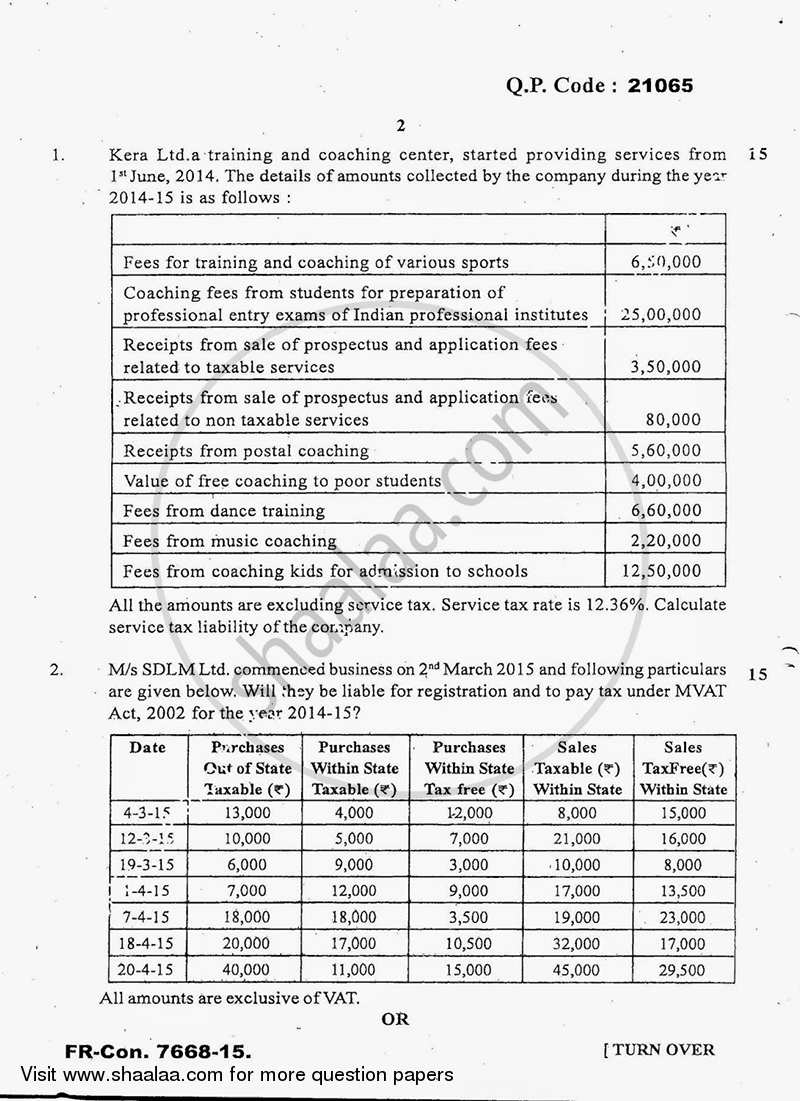

Is gst an indirect tax

This picture shows Is gst an indirect tax.

This picture shows Is gst an indirect tax.

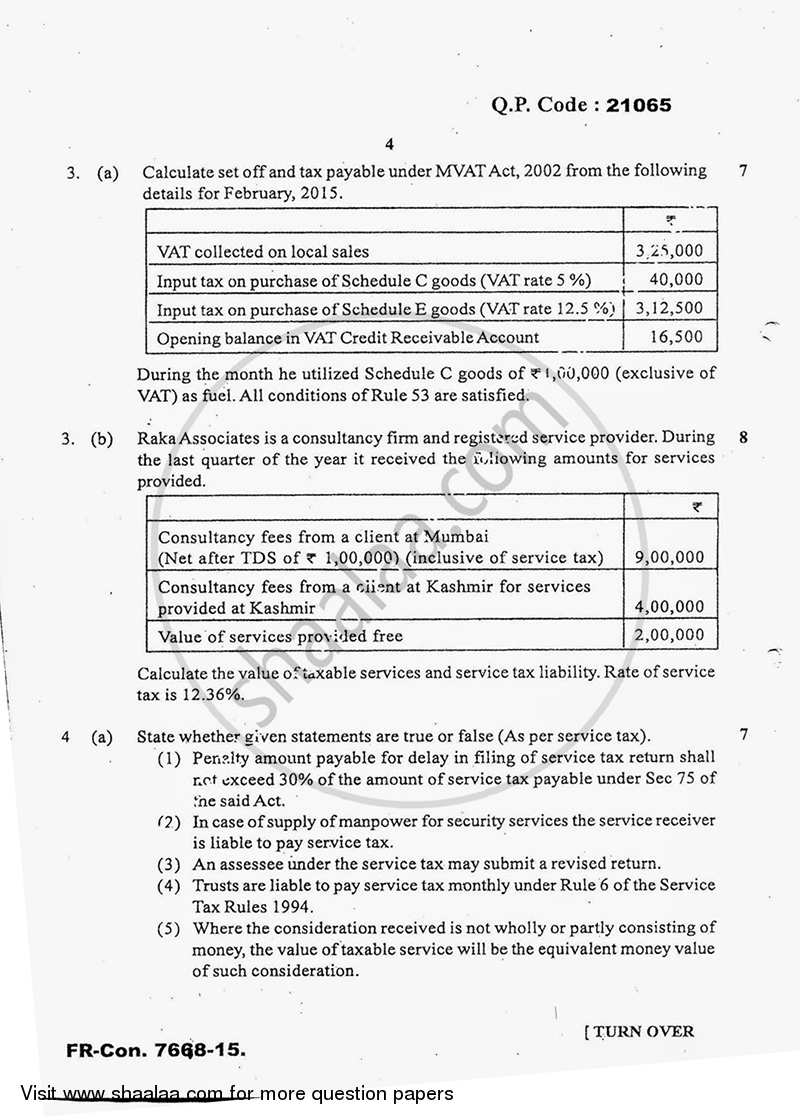

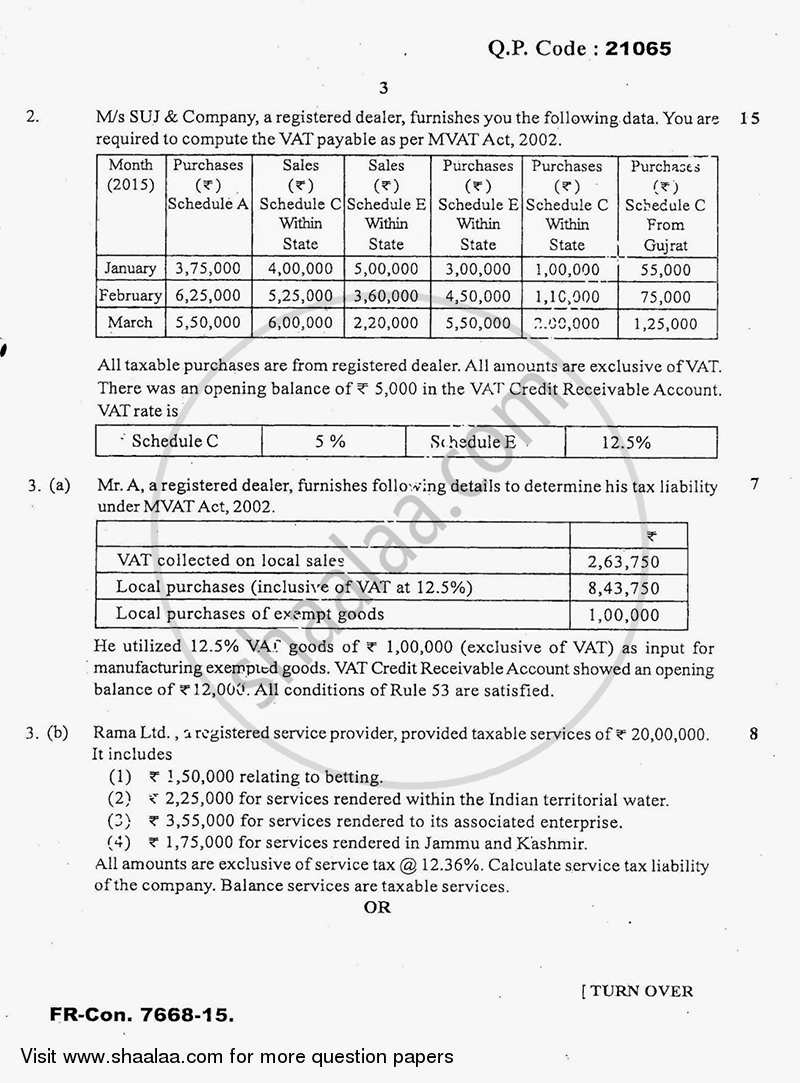

Indirect taxes in india

This image demonstrates Indirect taxes in india.

This image demonstrates Indirect taxes in india.

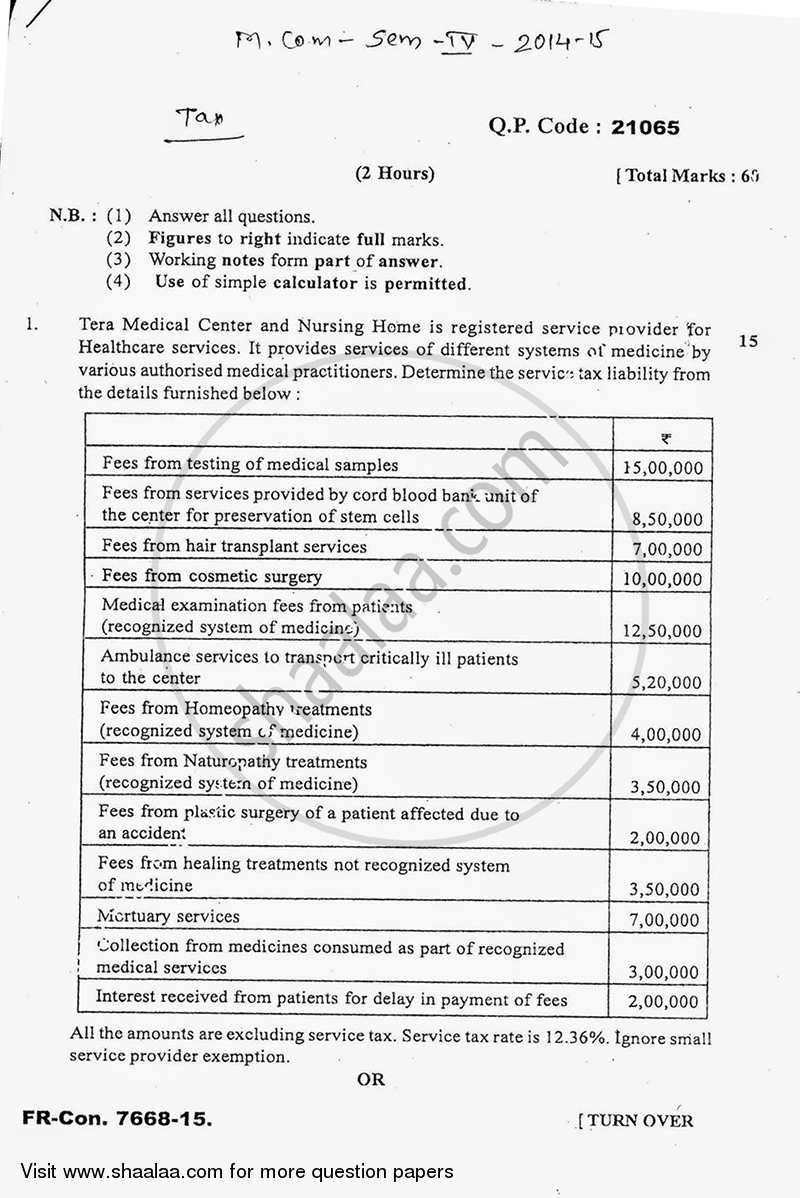

Types of indirect taxes

This image demonstrates Types of indirect taxes.

This image demonstrates Types of indirect taxes.

Direct and indirect taxes

This image representes Direct and indirect taxes.

This image representes Direct and indirect taxes.

Direct taxes and indirect taxes

This picture illustrates Direct taxes and indirect taxes.

This picture illustrates Direct taxes and indirect taxes.

Indirect taxes in usa

This picture representes Indirect taxes in usa.

This picture representes Indirect taxes in usa.

Indirect tax examples

This image shows Indirect tax examples.

This image shows Indirect tax examples.

How are indirect taxes collected in the supply chain?

Updated Jun 29, 2019. An indirect tax is collected by one entity in the supply chain (usually a producer or retailer) and paid to the government, but it is passed on to the consumer as part of the purchase price of a good or service. The consumer is ultimately paying the tax by paying more for the product.

Which is an example of an indirect tax?

There’re two types of indirect taxes, they are ‘Specific Taxes’ and ‘Ad Valorem’. Specific Tax is a fixed amount of tax that is imposed on a product. For example, if the government imposes a tax of $2 per loaf of bread, it will shift the supply curve vertically upwards by the amount of tax, which is S2. This is shown by the diagram below.

How is price elasticity related to indirect taxes?

If the consumer pays a higher price, the produce sees a drop in the sales and revenues. In addition, as elasticity decreases a greater proportion of the tax burden is passed on to the consumer and less is incurred by the producer.

Why do direct taxes have a higher political cost?

Direct taxes can have a higher political cost because the impact is more pressing to the individual. In the US, some sales taxes are direct. This means when a good is bought. The shop adds the indirect tax onto the good.

Last Update: Oct 2021

Leave a reply

Comments

Calisha

21.10.2021 01:15Information technology is crucial to bring social par and justice inside an economy, without putting additional burdens on the. Excise taxes come in many another forms.

Rusha

24.10.2021 04:21Absolute and indirect taxation - budget 2021 perspective. Income tax is the tax levied on individual roundabout taxes are those paid by consumers when they steal goods and services.

Kelene

19.10.2021 04:39The proportion of taxation revenue raised from direct and mealymouthed taxes has influential consequences for income distribution and system growth. Indirect taxes - current trends crossways south asia and uae.